In Part I and II, we covered Series LLCs and the core documents and the regulatory frameworks. In this article, we will highlight the responsibilities in the Finance and Operations realm required for a private fund.

In Part I and II, we covered Series LLCs and the core documents and the regulatory frameworks. In this article, we will highlight the responsibilities in the Finance and Operations realm required for a private fund.

To run a successful private fund, the three key areas that an entity should have strong competencies include:

-

Investments/Deals: The ability to source, invest and monitor deals that translate to profitable investments.

-

Capital Raise: The ability to identify prospective high net worth individuals, family offices and institutions interested in the fund's thesis that convert to investors in the fund.

-

Finance/Operations: The ability to comply with the regulatory and accounting requirements of the fund while also providing operational support for the investment and investor relations team.

So, you’ve put together a great team to address these three functions. One might ask, what key areas of responsibilities are encompassed within the Finance/Operations team?

These responsibilities fall into a few main categories: supporting the fund setup, overseeing investor onboarding, and overseeing ongoing accounting, regulatory and operations of the fund.

Supporting the Fund Setup

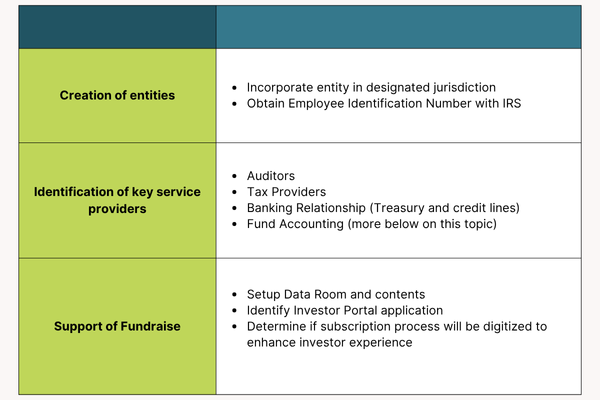

As the legal team is diligently working on the required documentation for the private placement memorandum, limited partner agreement and subscription documents, some attention needs to be paid to creation of entities, selection of key service providers and mechanism for communicating with investors both during and after the fundraise is complete. Below is a chart of some typical activity:

All this activity is before the fund is even launched and investors are committed to investing! So what happens now that you’ve done all the fund setup? What will keep the Finance/Ops team busy next?

Overseeing Investor Onboarding

Well, how exciting the capital raise has gone well and you have investors eager and excited to invest in your fund! Now the fun really begins! The Finance/Operations team become entrenched in a plethora of activities starting with evaluating the subscription document submitted by investors to ensure they are completed accurately. Sounds easy enough, right? Given the length of the subscription document, it can get a bit convoluted. Ensuring that all the necessary sections were completed thoroughly with proper support for know-your-client and anti-money laundering requirements is no small task.

From there it’s time for your first close. Determining how much to call is a balancing act and you should consider factors like funding upcoming investments, anticipated expense outlays, avoiding material cash drags which will impact IRR calculations and managing investor expectations on logistical demands of funding numerous capital calls.

Ongoing Accounting, Regulatory and Operational Responsibilities

Coordination, preparation and review of the calculations, reporting and regulatory requirements now fill the days of the Finance/Operations team. Below are examples of the main categories of responsibilities:

1. Governance

- Establish fund accounting policies, valuation methodologies, and internal controls.

- Monitor compliance with fund’s LPA and offering documents

2. Net Asset Value (“NAV”) calculation

- Calculate NAV and investor allocations, typically quarterly

- Apply valuations which reflect fund policy and investment inputs.

- Calculate management fees and waterfall.

- Book all journal entries for general ledger.

3. Cash Management

- Authorize and reconcile capital calls, distributions, and wire transfers.

- Process and monitor cash activity.

4. Performance & Reporting

- Maintain portfolio company data and performance metrics (IRR, DPI, TVPI).

- Provide estimated reporting and report performance to databases.

5. Audit and Tax

- Coordinate annual audit and tax filings with auditors and tax advisors.

- Review and approve tax allocations (Schedule K-1s) and annual tax return

6. Investor Services

- Maintain investor registry and commitment schedules.

- Prepare and distribute investor capital call and distribution notices.

- Produce periodic investor statements showing capital account balances, contributions, and profit allocations

Amazing how much this team needs to cover, don’t you think? An option many private fund shops contemplate is whether to outsource the fund accounting. Some questions to ponder include:

- Control: How much control do you want to retain on fund operations, reporting, and investor communications? How problematic is depending on an external administrator’s workload and schedules?

- Customization: How much do you want to tailor reporting, workflows, and systems to your unique strategy and investor preferences?

- Resources: Do you want to build an infrastructure to keep a skilled team of accountants, compliance staff, and operations specialists?

- Technology Costs: How much do you want to invest in building, buying and/or maintaining fund accounting and reporting software?

- Growth: How scalable is your proposed solution as more funds are raised?

- Independence: How important is it to your investors that a third party is used to independently validate NAVs and financials?

Smaller funds tend to keep fund accounting in-house due to cost, while larger or more complex funds often outsource for independence and expertise. However, if you plan to grow rapidly, outsourcing can free up internal resources to focus on analysis and review. Lastly, analyze the impact of total cost of salaries, benefits, and technology spend and compare it to outsourcing.

Either way, finance and operations play an integral role in the success of the fund and their importance should not be overlooked. Be sure to stop by their desk and thank them for their contributions as they add to the team’s overall success!

Summary

This post comes from Rho Blank of TriPeak Group, an outsourced CFO partner that collaborates with emerging fund managers to address their finance and operational needs.